GST Registration

All entities involved in buying or selling goods or providing services having revenue of more than Rs 20 Lakhs should register for GST. Complete your GST registration online with us in less than 5 working days

Turnover Exceeds INR 20 Lakh

If the aggregate turnover is more than INR 20 lakh (INR 10 lakh for North Eastern States), then GST registration is necessary and must be obtained within 30 days of reaching the threshold.

Inter-state Sales

If your business is engaged in supplying of goods or services to customers in another state, then regardless of your turnover, GST registration has to be obtained before commencing any interstate trade.

Compulsory Registration

For casual taxable person, or those need to pay tax on RCM, Non-Resident taxable person, Input Service Distributor, E-commerce Operator etc., it is compulsory to get the GST registration irrespective of the turnover.

GST Return and Filling

All person having GST registration must file GST annual return. We offer an easy process for filing GST Annual Return at an affordable cost, which is completed in 8-10 working days.

GSTR-9

All entities having GST registration are required to file GST annual return in Form GSTR-9.

GSTR-9A

All entities that have opted for the GST Composition Scheme are required to file GST annual return in Form GSTR-9A

GSTR-9C

Every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 of the CGST Act, and shall furnish a copy of the audited annual accounts and a reconciliation statement, duly certified, in Form GSTR-9C.

GST Letter-of-Undertaking (LUT) Filing

Exporters to enable exports from India without making IGST payment can file GST LUT. We offer an easy online process in filing GST LUT or Export Bond at an affordable cost.

Letter of Undertaking for Exports

According to the Central Goods and Services Tax Rules, 2017 any registered person exporting goods without payment of integrated tax (IGST) is required to furnish a bond or a Letter of Undertaking in Form GST RFD-11.

Export Bond for GST

Entities that are not eligible to submit a Letter of Undertaking would have to furnish an export bond along with bank guarantee. The bond should cover the amount of tax involved in the export based on estimated tax liability as assessed by the exporter himself. Export bond should be furnished on non-judicial stamp paper of the value as applicable in the State in which the bond is being furnished.

Temporary GST Registration

A taxable person under GST is anyone who is registered under GST or required to be registered under GST. Various criteria’s like turnover, business activity or transaction have been specified in the GST Act, which details persons liable to be registered under GST. Further, any person having registration under Service Tax, VAT or Central Excise on the date of GST coming into force will automatically be considered a taxable person under GST.

Who is a Temporary taxable person under GST registration?

The Goods and Service Tax Act defines a casual taxable person as a person who occasionally undertakes transactions that involve the supply of goods or services or both.

Hence, individuals running temporary businesses in fairs or exhibitions or seasonal businesses will need to get casual taxable person GST registration.

Casual taxable person GST registration is necessary irrespective of the annual turnover, and the process must be initiated at least five days before the business undertaking.

GST registration application for casual taxable persons can be made using FORM GST REG-01.

GST Registration For Foreigners

GST registration for foreigners is necessary for the non-resident taxable persons who are making taxable supplies in India. With India emerging as an economic powerhouse, a lot of non-resident Indias are willing to set up business in India. Hence, a non-resident taxable person has to apply for GST registration if he is undertaking transactions involving the supply of goods or services or both.

Eligibility Criteria

Irrespective of the turnover a non-resident taxable person is required to obtain GST registration in India. Here it should be noted that all the non-resident taxpayers are required to obtain the GST registration five days before commencing with the business activity.

Why GST registration

The Goods and Service Tax Law has improved the ease of doing business. The complexities of tax have reduced as the GST has subsumed multiple taxes into a single simple system.

GST Registration Cancellation

Easily surrender or cancel a GST registration at anytime due to various reasons like business closure, transfer of business or change of constitution.

Voluntary cancellation by the registered person

As per Section 29 of the CGST Act, the person registered under GST in the following circumstances can initiate a GST registration cancellation:

(1) Discontinuance or closure of a business

(2)Change in the constitution of business, which results in a change of PAN

(3) Turnover reduces below the threshold limit for GST registration

(4)Death of the sole proprietor

(5) For any other reason, proper justification has to be provided in the application.

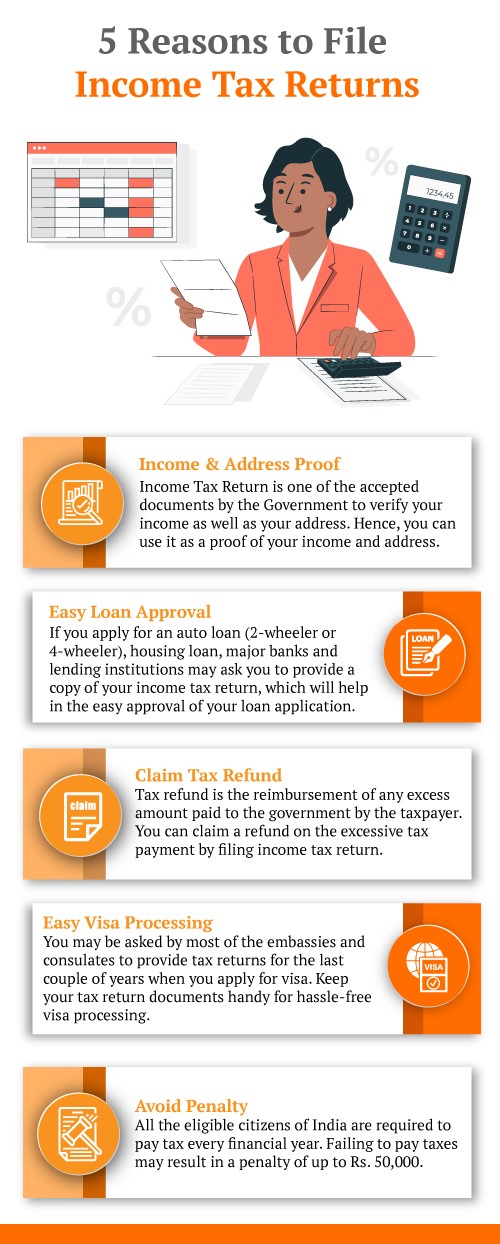

TDS Return Filing

File your firm's income tax return online with us at an affordable rate.

Alternate Minimum Tax

Required to pay alternate minimum tax at the rate of 18.5% of Adjusted Total Income. Alternate minimum tax would be increased by the applicable surcharge, education cess and secondary and higher education cess.

Income Tax Return

India must file their ITR on or before 30th September of every calendar year. In case of not filing the same before the due date will attract penalty.

Auditor Appointment

All companies registered in India must appoint a statutory auditor within 30 days of incorporation. In case of not appointing an auditor before the due date, it will lead to a penalty of INR 300 per month and the company will not be allowed to commence business activities.

ITR-1 to 7 Form Filing

To help taxpayers and make the ITR filing experience smooth, the Income Tax Department has issued revised instructions for filing ITR forms for A.Y. 2020-21.

ITR-1

Eligibility - This Return Form is for a resident individual whose total income for the AY 2021-22

ITR-2

Eligibility – For an Individual or HUF not eligible to file ITR-1 and not having income from business or profession

ITR-3

Eligibility – For an Individual or HUF not eligible to file ITR-1, ITR2 or ITR-4 and having income from business or profession.

ITR-4

Eligibility – The current ITR 4 applies to individuals and HUFs, Partnership firms (other than LLPs), which are residents and whose total income

ITR-5

Eligibility– This form can be used by person being a – Firm, LLP, Association of Persons (AOP), Body of Individuals (BOI), Artificial Juridical Person (AJP), Local authority, Co-operative Society, Society registered under Societies Registration Act, 1860, Trust other than trusts eligible to File ITR-7, Estate of deceased person, Estate of insolvent, Business trust, Investment fund.

ITR-6

Eligibility– This ITR form can be used by companies as per section 2(17) of the Income Tax Act. This form is filed by companies other than companies required to file return in Form ITR-7.

ITR-7

Eligibility– This return form can be used by persons including companies required to furnish return under section 139(4A), 139(4B), 139(4C) or 139(4D).